RED LIGHTS FLASHING FOR SILVER USERS

Copyright © January 2008 presented by Charles Savoie

"WE ARE THE KELVINS! WE DO NOT COLONIZE! WE CONQUER! WE RULE!"---Alien captor to Captain Kirk on original "Star Trek"

The silver investing community has monitored the Silver Users Association since Butler first mentioned them on March 27, 2001. Subsequent to that I began researching the "nonprofit" organization, whose stance on silver gives every suggestion of being identical in mind-set to the opening quotation. The Silver Users Association is our Kelvins, so to speak, with a paralyzer field that caps prices. Actually there is a much older and superior influence that maintains the price ceiling. After a review of some items, you should consider the closing comments as being certainties, not potentialities.

To those of you expecting the historical review series on silver in the Great Depression years to continue this month (postponed till next month), be advised that I considered this priority item red hot as consensus is that silver must break out higher in 2008. When it does, the Silver Users Association will scream so loud as to wake those deceased who were deaf in their lifetimes!

Another high profile silver commentator with international standing, Jason Hommel, observed in October 2005 that the Silver Users Association is "devoted to the conflicting goals of keeping silver prices low and keeping silver available for users." The insolence against economic law must end. As Butler has said, you can’t consume more of something than actually exists. You can’t get natural red diamonds for the price of synthetic rubies. Silver is now scarce---not abundant. Another severe fact for the SUA is that price capping causes shortages. We cannot be faulted for having our suspicions more than deeply aroused when we see various CFTC commissioners addressing the SUA in flattering tones---almost as if they are on bended knee--- and then one of them---Newsome--- is tapped to be a top administrator in the NYMEX. On May 23, 2001, James Newsome addressed the Silver Users Association www.cftc.gov/opa/speeches01/ and sniveled to them---

"It is both an honor and a pleasure to address this distinguished group. I look forward to working with you."

We may reasonably assume that as CEO of the NYMEX, with its COMEX subsidiary, that Newsome is still "working with them" and regards it as "an honor and a pleasure." From all points of cyberspace the whisper of the word "collusion" reverberates and cannot be silenced. To what depths does the appearance of complicity translate into practice? We must assume there are no limits. No one has yet offered any answer, let alone a plausible one, for why the COMEX short profile in silver so massively overshadows that of any other traded commodity---as Butler points out.

The unlawful price capping of precious metals obstructs the true net worth of gold and silver investors from being expressed. We are being outlandishly shortchanged as you read this. By the time the silver price is fully expressed, capital gains tax rates will be sharply higher, hampering our ability for doing good by supporting those charities which are important to us individually. The interminable era of unnatural low silver prices promises chronic supply deficiency. Currency crisis dictates that the supply shortfall arrives sooner than the ongoing industrial deficit alone mandates. Among our investments we should consider going heavily short SUA corporations. While the SUA has belittled silver as an investment over the years, too many smart people know otherwise. Let’s briefly review a few facts then I offer the SUA bitter conclusions it must face.

THE SILVER SUPPLY DEFICIT

We won’t list over 200 documented references on this as I did in "Severe Oversupply Of Liars"

Just three will do for refresher---

"NOT SINCE 1950 HAS WORLD OUTPUT OF SILVER EXCEEDED CONSUMPTION, and the discrepancy has been increasing sharply in recent years." (Commercial & Financial Chronicle, April 15, 1965, page 1580)

"Since 1951, silver consumption has exceeded its extraction from ore."

www.atsdr.cdc.gov/toxprofiles/tp146-c4.pdf

This document comes from the Centers for Disease Control. Silver is increasingly needed for disinfecting hospital environments. The PDF referred to the Silver Institute as of 1990. It’s well known that the silver market has functioned in a deficit since the early 1990’s. But in fact, this has been the case for most of sixty years! The Wall Street Journal, March 3, 1980, page 28, suggested that the deficit started in 1949---

"FOR MORE THAN 30 YEARS, WORLD SILVER CONSUMPTION HAS OUTDISTANCED NEW PRODUCTION--- in 1979, total usage was 161.8 million ounces above production. The difference was supplied by sales from private stocks and bullion recovered from melted silver coins, silverware and scrap. New production isn’t expected to increase appreciably."

The Silver Users Association must deliriously agonize not only over domestic competition for silver, but the world contest for it! According to The Economic Times of India, December 6, 2007, "China, India, Vietnam, Russia, Brazil and other emerging economies" are demanding more silver. While the SUA companies have some branches in India, it appears doubtful the Indian government will allow these to receive preferential treatment in silver over domestic companies. Butler recently gave his view that China is the big silver short. I suggest that if that’s true, China is clandestinely fronting for United States interests.

If the Federal Government price caps silver---as it did for part of the Nixon administration with Richard Cheney---this will cause silver mined elsewhere to flow to nations where miners can realize free market prices. That’s a real acidic taste in your mouth, isn’t it? Fortune Magazine, December 1945, page 272 spoke of this very situation when it admitted, "IT HAS BECOME IMPOSSIBLE TO ENFORCE A TWO-PRICE SYSTEM." America cannot mine enough argentum to meet its own needs. Output will go to whoever bids the highest rates. Being self-implied as having priority rights to silver will be viewed as the sick joke it is. Okay---that’s enough about the deficit. It’s not likely the leasing of silver can do much for the SUA in 2008. Leasing is a factor of yesteryear. After a three-generation deficit the well must go dry.

SILVER SUPPLY DISRUPTIONS

"Rhodium Jumps As Auto Makers Scramble For Material" was a Reuters press release from late November 2007--- http://investing.reuters.co.uk/news/articleinvesting.aspx?rpc=401&type=allBreakingNews&storyID=2007-11-23T133014Z_01_L23634601_RTRIDST_0_METALS-RHODIUM-RISE-UPDATE-1.XML

What does an unserviced deficit herald for silver but higher prices? In fact "Using Silver In An Era Of High Prices" was the topic of Jeff Christian’s address to the SUA around November 6, 2007. I sarcastically think that any silver price above one cent per metric ton delivered seems exorbitant to the SUA, and that’s only if it can get four niner fine. The item above mentioned a rhodium shortage accompanied by the unavoidable price spike. Recall several years ago the same thing took place in palladium. On November 14, 1998, Butler forecast "A Permanent Shortage Of Silver." Due to the problem of universal currency depreciation, millions worldwide have sought protection in silver in addition to gold. Oh, but we outside the SUA don’t have any rights to silver! The International Monetary Fund has remarked that "gold and silver are non-monetary assets" so Uncle Sam, with whom you are in bed, shouldn’t mind. You sound like the Water Users Association (see below). The consequences of a manufacturer being unable to secure physical silver metal were detailed on June 27, 1946, in the Commercial & Financial Chronicle, page 3537---

"Because silver is off the market, new cars may be off the highways," John Tebben, of the H.A. Wilson Co., Newark, N.J., manufacturers of electrical contact points, declared in a statement issued June 21. "That may sound like a headline for a tabloid," he added, "but I’ve been trying to think of some way to ram home a hard truth---and that’s the best I can do. SILVER IS THE CRITICAL MATERIAL IN THE PRODUCT WE MAKE. IT IS NOW UNOBTAINABLE."

"If the automotive industry were able to operate at full capacity, deliveries of the cars everybody wants and needs probably would be halted in three weeks by the exhaustion of the supply of electric contact points. They make and break electric currents. THE POINTS ARE OF SILVER. THERE ARE A DOZEN OR MORE IN EVERY CAR. BY MID-MAY WE WERE SCRATCHING BOTTOM ON SILVER SUPPLY. We were reprocessing scrap. We stopped making deliveries."

"Our industry is hit by a silver famine, WHOSE EFFECTS SHORTLY WILL BE FELT BY MANY BIG INDUSTRIES. This will cost many industries much and it may cost a great many employees much more."

What this silver user intentionally left unsaid was the problem of Federal price capping of silver. The OPA---Office of Price Administration---an exact parellel to Mussolini’s brutal Fascist Italy---had a price cap of 71.11 cents on silver. The miners were trying to get a 19.39-cent per ounce increase, just in order to bring domestic silver up to world levels. The silver users and bankers were stonewalling! What is the problem? When orebodies decline in richness of grade recovery costs increase! As the Federal Reserve dilutes the so-called money supply, mining expenses rise! A law the Fed detested required the Treasury at that time to maintain a silver bullion reserve for redemption of circulating silver certificates. The silver users and the Federal Reserve despised that fact. The Colorado Mining Association ran an ad in the New York Times, May 31, 1946, page 10, complaining that "our position has been continuously misrepresented by skillful propagandists" and "our Western position has been grossly misrepresented." The advertisement added---

"Now there is another crisis in silver. It is a manufacturing crisis. It is due to a 200% increase in the industrial use of silver since 1940, along with a 57% drop in domestic silver production and a virtual collapse in imports. IN FACT, WHILE YOUR INDUSTRY PROSPERED OVER 3,000 OF OUR SILVER PRODUCING MINES WERE SHUT DOWN. For months past we have again offered you our cooperation in the hope of terminating the present manufacturing crisis in silver. Our Western Senators and the small number of Congressmen who represent us have been continuously maligned and vilified."

It is as Butler has said, the SUA has fouled its own waters. By fanatically exerting itself for sixty years to suppress prices by lobbying, the supply shortage will appear and cause damage to the very users to whose processes it is indispensable. An implied claim the SUA never vocalizes is that they can’t pass on price increases in silver to consumers in the same way they transmit all other price increases factored in, such as natural gas. That is an outrageously bizarre myth that has been true to some extent only in sterling tableware. In all other applications silver is a small percent of the cost of the finished item. The boorish implication that the SUA has a legal claim to all physical silver is way beyond preposterous, yet one encounters it in reading between the lines in all manner of web documents and in the public record.

Just one case in point will do, the American Metal Market, November 9, 1998 reported, "India Silver Hoarding Worries Users Group." It isn’t only silver in America, but globally---that the SUA claims as morally exclusive to be theirs alone! Such a grasping, acquisitive, greedy outlook by a truly voracious hooligan gang of corporations! We are aware of no other users group in any commodity! What makes the SUA different? Obviously the paper money crowd wanted to feed silver to the SUA in the hopes of forever eliminating it as a monetary medium. That was the reason for the so-called Treasury silver "auctions" of the late 1960’s into fall 1970. I addressed this topic of monetary suppression in "Michael Gorham's Paper Money Mob"

The December 1945 Fortune Magazine, page 272, complained about "the ancient tendency of the population to hoard silver" as if that were a biological disease on the part of India. Over 60 years later and guess what? Indians still trust in silver and have no inclination to immolate themselves for the Silver Users Association and the synthetic money creators.

The response of new CFTC chief Bart Chilton to Butler’s recent address to him was as wretched as being offered a malodorous plate riddled with insect vermin in some Civil War era prison camp. We would be interested in knowing which specific Wall Street spooks were the ones who administered "illumination" to Chilton before being installed as the professional dummy marionette that he is at the agency. Is it pure coincidence he was born in Delaware, the DuPont run state? It’s ironic that he was VP of the National Farmers Union for over a year, considering that the old "Farm Bloc" once voted with the Western Silver Senators. Among pro-wrestling antics their colorful descriptions are sometimes hilarious like the one who said, "You look like somebody I beat up a couple of years ago!" I won’t say that about Bart Chilton, but he does remind me of a superficial fellow I once saw who callously walked past someone face down bleeding on the sidewalk. He was the first to approach the victim and offered no aid as he walked away with a scornful laugh.

Chilton directed the silver world to re-read Michael Gorham’s "analysis," which is now several years old and which I totally debunked insofar as Gorham slickly articulated that he couldn’t understand why anyone would want to depress silver prices! No reply was posted anywhere on the World Wide Web in any attempt to repudiate what I said. In his December 10, 2007 item, Butler stated, "we are very close to a silver shortage." Prices will certainly spike in 2008, some five years after many of us looked for it to happen. CFTC commissioners can still send valentines to the SUA but nothing will be able to manage prices down.

There is an organization with far less legislative influence, the Industry Council for Tangible Assets, mostly concerned with numismatics but also with bullion. Readers may wish to visit their site, examine it, and send them possible policy suggestions for an expanded position statement on metals http://www.ictaonline.org/

Those of us affiliated with the producing side of the silver market are keenly interested in having our Senators and Representatives ask the Justice Department to explain why they don’t regard the Silver Users Association as an antitrust problem. Just like we’re waiting for a leading oceanographer to publicly admit that his real name is Mike Nelson (played by Lloyd Bridges in "Sea Hunt.") It would be a tabloid story like "Elvis Is Running A Catfish Farm In Biloxi, Mississippi."

Consider the importance of natural gas, water, uranium, electricity, lumber, copper, cotton, cocoa, and petroleum. What if a Water Users Association sprang up that represented 80% of the water use in America and suggested that those owning private water resources---lakes, ponds, small reservoirs, wells, aquifers and so on---had no right to such water, and that government action was necessary to commandeer the remaining 20% for the sole benefit of the Water Users Association? Those who use the other 20% of the silver here aren’t lightweights and would oppose any SUA attempt to restrict all available material to being dispensed exclusively to its members. View the membership list of the National Association of Electrical Manufacturers---including General Electric---at www.nema.org/about/members/index.cfm

We know that GE uses mountains of copper but also some silver, as well as Intermagnetics General and American Superconductor. Zale Corporation uses silver. And there are numerous others. Why haven’t these companies accepted the SUA’s open invitation, at their website, to join? Could it be someone has antitrust concerns? If SUA companies cannot obtain adequate silver to maintain production their shareholders may sue management once a court rules the SUA a cartel, hence illegal. No petty copper thieves are SUA members!

We’ve seen over the years what kind of influence scale the SUA operates on. First it was illegal to melt silver coins, but later it became legal. When the SUA determined that they would benefit by being able to melt coins, the law was rescinded. On May 19, 1967, the ban on melting other than by the Treasury went into effect. The Wall Street Journal, December 6, 1968, page 9 reported silver users asking the ban to be lifted "in certain circumstances," meaning, when beneficial to themselves. In order to partially blunt the appearance of being a spear-carrier for the users, a five-month delay was staged, and Treasury lifted the ban on May 12, 1969. We still have a discriminatory 28% taxation rate on physical silver gains. I don’t think Tiffany pays such a rate after marking silver up several dozen-fold.

Tiffany prices silver in the same way some freak would price coffee who was the only one on earth who could secrete it from a unique gland on his body! Though if there were such a freak we can’t see why anyone would want a sip, and it barely makes less sense than Tiffany’s lurid prices! We must suppose that when the SUA determines it’s to their advantage that the capital gains rate on metals be lowered to that of securities investments---15% if held over one year---the 28% rate will be scrapped. Investors (not "hoarders") are declining to sell until the tax environment normalizes. Actually the tax rate should be under 15% in order to partly compensate for the discrimination that so many have already suffered. Beyond that, reducing the tax rate on hard metal gains to zero would act to bring much material into the marketplace. This current banker and SUA favorable 28% charge adds to the silver shortage. We are waiting for normal tax treatment before becoming even possibly motivated to sell. The penalizing tax rate on hard silver causes who knows how many tens of millions of ounces to remain very defiantly frozen from entering the market. Think about that, punk! Wearing a suit and tie to work won’t be of any use in this matter.

You cannot employ the Federal Government to confiscate physical silver from investors by appealing to crisis economics. Your concern isn’t for American jobs as we will mention below. After carting off the majority of the silver in the once 165 million ounce strategic stockpile, we cannot be turned to as scapegoats to restore it. Only the culpable must be made to answer for the shortage. Whoever heard of in criminal law, any unconnected party being forced to make restitution for what an unrelated party took? Answer the question! In the event of any Federally announced confiscation, forfeiture or nationalization of silver---one pretext being "national security purposes," that is, war material---silver investors will make their own individual choices as to their response. A class action lawsuit is the most certain mass response. With our websites we can organize the necessary plaintiff lists in several days. Someone will say---the Liberty Dollar seizure in November 2007 is adequate precedent. But none of us have printed any paper notes that purport to correspond with any metal.

Naturally the first silver targeted in a seizure will be that of investor owned metal in COMEX warehouses. It’s just too easy to access since it represents a convenient high concentration of bullion at a few sites. What would be next? Federal orders closing down all gold and silver dealers? Would the public be told it’s a prison term offense to dispose of gold and silver in any manner other than "deliver it to the nearest IRS office" (or other Federal location?)

If the Government ordered confiscation, we are sure the silver users would be meeting with them in order to declare their rights to all or at least most of it and probably be placated. Mr. Bush was elected with help from a Dow Chemical executive. If forfeiture happens most consumers would never again purchase any product offered in the marketplace by the SUA roster of companies, because they will not reward theft behavior. I would not be so blithering stupid as to store even one gram of silver where I reside. What, do you want my mirrors? It’s stored with someone who actually doesn’t care about money due to ascetic religious views but refuses to recognize it as owned by anyone other than myself and the Almighty. He has instructions to dump it into the ocean 15 miles out, or elsewhere that it would be terribly expensive to retrieve, or to disperse it among several hundred people, in such event, or in case anything happens to me.

I urge everyone with silver to sacrifice it rather than let the miserable government we have confiscate it. If enough of us show such resolve, as evil as they are, they may reason it’s easier to allow a free market than to confiscate. I support the orderly and just restoration of a national silver stockpile with those who caused the depletion footing the bill for replenishment, but I will not be a party to assisting global interventionist warmongers.

The other pretext for Federal seizure is "the money system is broke and we have to have the gold and silver," yet we would be "compensated" in the currency they admit has no value. "We have to halt money laundering and terrorism, and we need it to transition to the Amero." No, what they really need it for is to financially break us, because we aren’t members of the Secret Society or any of its unofficial subsidiaries. They don’t use competition to impoverish others; they use illegitimate government action. There’s a worthwhile item on confiscation at---

http://www.reformation.org/roosevelt_confiscates_gold.html describing among other matters the 50% transaction tax on silver that was imposed in 1934. I have seen plenty of innuendo that many members of Congress, certain Federal Reserve officials, Wall Streeters, Federal Judges and State officials, have taken delivery of gold and silver. I now address The Pilgrims Society in New York because you and I both know no one else is running this country. The people of this country will not tolerate any two-tier system of confiscation/exemption for this organization and its direct subsidiary, the Council on Foreign Relations. Friends, this is the sole internationalist organization for which we cannot obtain any current membership roster. Several executives of the New York Times have lists, because they’re members.

John Whitehead ex of Goldman Sachs is on The Pilgrims executive committee. The President is always a member and the President has the illegitimate authority to order confiscation. "One President after another has done his bidding" said biographer William Hoffman of David Rockefeller in 1971. Hoffman mentioned Bilderberg but was unaware of this Society. Today Pilgrims member Peter G. Peterson runs the Council on Foreign Relations as Rockefeller’s chosen successor. If any President issues a precious metals confiscation order, it will be because this hidden organization of gold and silver suppressors, thousands of times more important than the Silver Users Association, has told him to "go ahead." Additionally, if any attempt, successful or not, is made on the life of Congressman Ron Paul of Texas; or if there’s a wreck or plane crash, because he’s campaigning for President and holds the "wrong" views such as returning to gold and silver as money, WE WILL INSIST THAT CONGRESS INVESTIGATE THIS ORGANIZATION---

No appeal to privacy ("concealment") can be substantiated on the basis of being a private membership organization. I can identify way too many Generals, Admirals, Ambassadors, Senators and other Government officials over the years for such attempt to be credible. Come clean---who the hell are you people? 600 plus a waiting list other than the 100 or so I can currently "finger." Exactly who, other than that of top Wall Street figures and big inheritors and people who aren’t on the big rich lists but belong there and those down in rankings who belong at the top. SUA companies over the years that have had Pilgrims on their board include Kodak, Union Carbide, Dow Chemical, DuPont and Tiffany. I recall names such as Caesar Augustin Grasselli; Lammot DuPont Copeland; Birny Mason Jr.; Kenneth Rush; Philip Reed; and Walter Hoving. Englehard also must have had some.

There can be no doubt that these are the personalities who have intentionally led America down the road towards fiscal doom in order to scrap the dollar and institute the Amero in concurrence with eliminating the Mexican and Canadian borders. Mexicans streaming into "El Norte" may find it less desirable than conceived, as they will be the means of having no military conscription. Who knows how many Mexicans these bankers plan to send to the Middle East to fight for their planned seizure of Iran by 2015 to 2020. There will be time in the interim to amass a military applications silver stockpile, mainly from Mexican silver sources.

By the time enough Americans realize that no vote for any Presidential candidate fielded by either major political party will do any good---because the Secret Society controls the nominating process of both parties---and because their media apparatus has the capacity to ruin a worthwhile contender---it will be too late. If the North American Union can be made to materialize the Union would declare a value ceiling on silver so that DuPont can continue to use miners as hosts for its parasitism. I warn all metals investors to beware! They will have a tyrannical hemispheric price control agency or an "authority" to which miners must deliver metal in exchange for shinplaster Ameros. MEXICAN SILVER WILL NOT BE ALLOWED TO BE SHIPPED OUTSIDE THE UNION FOR HIGHER PRICES! If that fails to motivate you to be politically active, prepare for a future of poverty, no matter how many shares you own! A classic case in point was DuPont director Andrew Brimmer who as a COMEX governor in January 1980 took part in the action to send silver prices plummeting.

Mr. Salinas Price, please discuss with your Governor friends in silver the threat posed to Mexico’s sovereign status by this Union the bankers plan to foist on us all. It is not necessary to trade, tourism, investments or diplomacy.

We are certain the SUA is keenly interested in who the next President will be. Have you already flexed your tentacles and made contact with The Hilarious Rotten Illuminated One ("Hillary Rodham Clinton") and Order of the British Empire, Rudy Giuliani, friend of silver suppressor Donald Rumsfeld? God save America from both these freakazoid contenders. They will drag us into the North American Union if they can. Ron Paul doesn’t get invited to Bilderberg, which is the place high officials like Texas Governor Rick Perry get marching orders. If Ron Paul gets elected, he must immediately change all Secret Service personnel! "Billary" frowning and shaking her finger would say---"I’ll put a Federal price ceiling on those immoral silver people!" Giuliani with his clammy face would ominously say, "Hey, I’m in with Wall Street, and we don’t tolerate silverites getting ahead!" I don’t imagine the SUA cares for Ron Paul because he wants to use "hard" money. The SUA’s stupid view on currency is "just print paper money and spend it" (Commercial & Financial Chronicle, April 30, 1953, pages 1872-1873.)

As soon as the Government assures that there will be no silver seizure, we can regard it as certification of happening. Many of us will convert into other assets. Even diamonds and colored stones will be considered. Friends, discuss with your accountant and trade your silver to members of Jewelers of America, with 11,000 locations nationwide. Since silver will be recognized as in critically tight supply, tell them that if they want your metal for stones, to get into Polygon and trade you diamonds for their cost (without the "Trade-Lock" feature activated.) If they decline, walk out. You must show up unannounced so that they can’t contact vendors and ask for price alterations. There is nothing to prevent them selling at cost if they have reason to and your stones could be a reserve inventory for them to liquidate but only at prices to your advantage (two to five years out.)

You can also contact some diamond sightholders in New York and propose a deal, provided they can convince you that you’re receiving the same rate as those they normally sell to; or Zale Corporation. Silver will be much tougher to source than diamonds, rubies, emeralds, sapphires, spinels, black opals, cat’s eye and asteriated gems. While these lack fungibility and aren’t money, they are wealth and would be better to hold than the government’s worthless rubbish currency, now going into repudiation by the rest of the world because it’s litter. Gems have never been used as money to extent to compare with metals, and would not be much of a confiscation risk. Trade silver for land ownership in rural areas suitable for water well drilling. Better still, consider shifting into water rights ownership because look what happened in Georgia in 2007. Water will be a more imperative form of wealth than gems, but you still can’t carry much around as with stones.

TREASURY CONTROLLED BY THIEVES

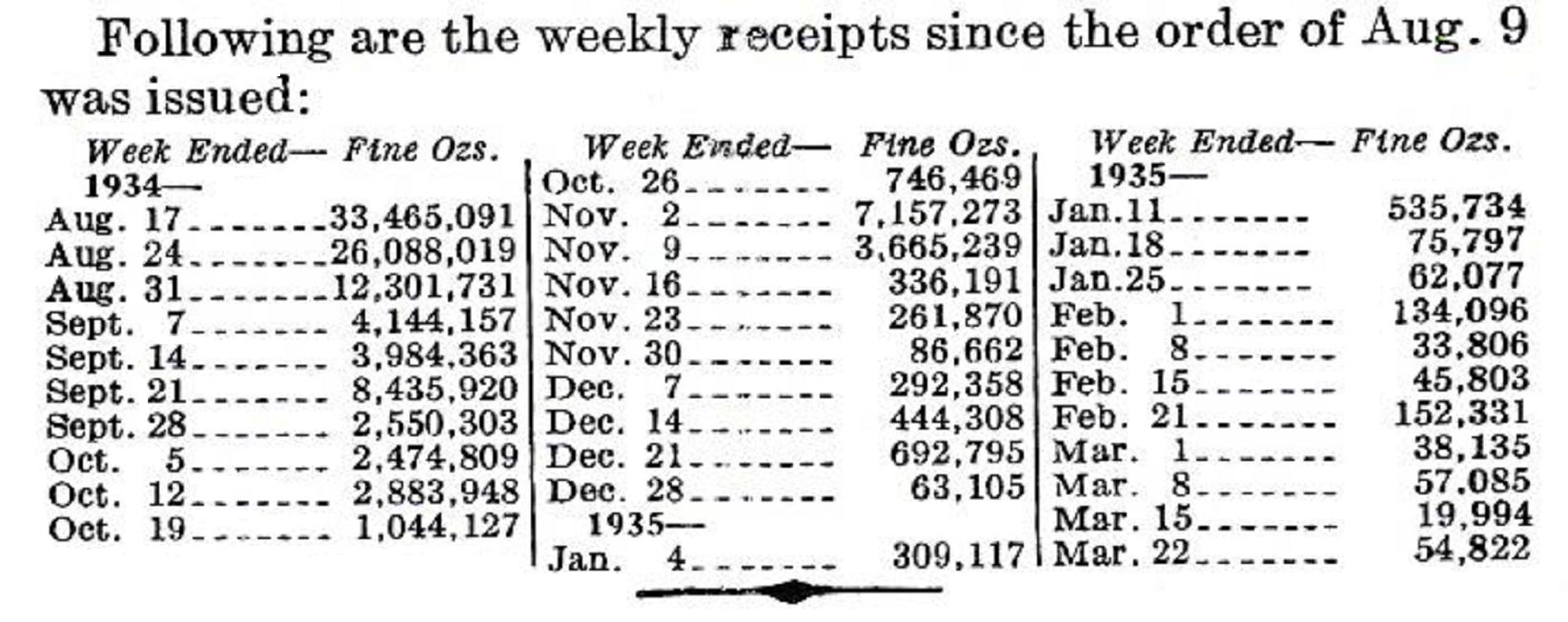

Franklin Delano Roosevelt, member of The Pilgrims Society---the World Money Power---nationalized silver by executive order on August 9, 1934. He of course also violently assaulted the rights of sovereign citizens in gold. His Treasury Secretary was Henry Morgenthau Jr., second-generation Pilgrims Society member. The Commercial & Financial Chronicle carried regular reports of surrender of metals by citizens at mints and assay offices. Let’s review some specifics from January 5, 1935 inclusive through May 16, 1935. The following enumeration comes from the March 30, 1935 issue---

That totaled 112,637,535 ounces troy of fine silver lost in about seven and one half months by rightful owners to behind the scenes manipulators because the wrong people were in control of the Federal Government. 15,018,338 ounces taken by robbery every week! Of course, those stats didn’t represent the entire theft, but it’s adequate to get the picture. THE SECRET SOCIETY THAT CONTROLS THE UNITED STATES PRESIDENCY AND ALMOST ALL OF THE NOMINATING PROCESSES AT THE NATIONAL POLITICAL LEVEL OF BOTH MAJOR PARTIES INTENDS TO CONTINUE STEALING FROM WE THE PEOPLE! Yes, they took citizens gold also. The Commercial & Financial Chronicle, March 30, 1935, page 2104 mentioned "hoarded gold" being turned in at Federal Reserve Banks Treasury offices and the New York Assay Office to the extent of $2,067,500,000.

THE SUA SPEAKS ON SILVER

"No one seems to want the metal." (Business Week, July 23, 1955, p. 54)

Of course Business Week isn’t listed as a SUA member. The fact that it has had many full-page ads over the years from Dow Chemical, DuPont and Eastman Kodak is sufficient to influence editorial policy.

"WE DO NOT KNOW WHAT THE PRICE OF SILVER WOULD BE IN A FREE MARKET."

---Donald Ramsey, retired Admiral, legislative counsel to Silver Users Association, Commercial & Financial Chronicle, August 30, 1962, page 909. 45 years later Butler did an article, "Living In A Blind Man’s World" on this topic of how none of us have ever seen a free market in silver. Back to Ramsey, on the same page he said, "Silver has no guaranteed value."

If the SUA’s view on silver is that it has no guaranteed value, it appears that this cancels out all their expressed concerns. Why beef about something that has no guaranteed value? I saw a photo of this Ramsey once and his face was so ugly it would have made a hungry mule back away from an oat bin. Then there was Walter Frankland with his "genteel" appearance who was probably happy to see silver miners like Sunshine, a great American name, go broke in the face of too many years of suffocating low prices. Poisonously, the SUA is on record stating, "Silver users are very sympathetic with the problems of the silver miners." (Commercial & Financial Chronicle, April 30, 1953, pages 1872-1873.) They were also so brazen as to state we were "trying to take silver away from the common man." I submit, with thousands of years of history as corroboration, that silver coins are far more important to a sound economy than everyone being able to own sterling silverware.

American Metal Market, December 12, 1989, quoted Michael Boswell of Sunshine Mining (since bankrupted by COMEX naked short sellers and silver leasing) as stating---

"New York ---The head of a major silver-producing company said last week he blames commodity traders AND SILVER USERS for keeping silver prices artificially low, and said that silver market conditions are not being adequately reflected in price levels on the Commodity Exchange.

"SOMETHING IS REALLY WRONG WITH THE SILVER MARKET," Boswell told the annual convention of the Northwest Mining Association in Spokane, Washington, last week. "THE PRICE OF SILVER COMPARED WITH THE PRICE OF OTHER METALS IS APPALLING."

Alonso Ancira, a Mexican national who was part of the ownership of Real Del Monte and Pachuca silver mines, was quoted in the Wall Street Journal, May 1, 1991, page A-12 as complaining in response to having to shut down operations and cut off miners employment, dispossessing entire families---

"Prices are the worst in the century."

American Metal Market, July 5, 2002, quoted Frankland of the SUA, in reference to his expressed belief that the government had another 25MOZ squirreled away someplace, and that they got it back in the 60’s at $1.29 an ounce---

"As long as they’ve got silver not being used for any other purpose, it makes sense to use the $1.29 silver and not go out into the marketplace and purchase silver at today’s prices."

Gee, these folks who tunnel into resources owned by others such as taxpayers, never quit. If there’s a gram anyplace, it needs to be transferred to them at $1.29 an ounce, regardless of what the super shorted COMEX price is!

Silver investors understand that a bigger threat to their rights comes from the financial community, than even that of the silver users themselves. The Federal Reserve detests the idea that any American can hold something that can shield from monetary debasement. Banking, the magazine of the American Bankers Association, said on page 117 of their April 1965 issue---

"SILVER HOARDING WOULD HAVE TO BE OUTLAWED."

The National Review, June 14, 1966, page 579 remarked---

"MILLIONS OF PEOPLE WOULD HAVE TO BE PUT IN JAIL FOR HOARDING SILVER IN ONE FORM OR ANOTHER."

Friends, do you suppose the Silver Users Association or anyone else has enough influence to send millions of people to jail, or even several hundred thousand, for withholding silver from their voracious jaws? America’s prisons and jails serve the public by detaining violent criminals---not citizens who stand with the Constitution’s directive of precious metallic money versus bastardized junk currency. What would be the manpower costs to the non-silver owning taxpayers of sending bully boys to pick up all the silver owners, dig up their backyards and turn their houses into splinters and rubble looking for silver, and incarcerate them? All for the benefit of an organization whose members would rather run barefoot across jagged glass gargling muriatic acid sprinting straight into blazing eternal hellfire rather than pay free market prices for one specific raw material for which they can already pass along the cost to consumers anyway? I’m going to tell you silver users something straight out---the best thing you can hope to do for yourselves is to dissolve and disband your so-called "nonprofit" organization, and disperse. (They must mean "nonprofit" for miners and investors!) The United States Government cannot save you from your history. We’re mad as hornets and we’re not going to take it any more---

(Giant Japanese hornet to scale with human hand.)

The July 1963 issue of Banking, page 58, complained about "the silver mining interests and their spokesmen in Congress."

Apparently bankers are of the view that silver miners and investors are entitled to no legislative representation. It reminds me of the time in the 19th century that bank stock was exempt from taxation in New York State due to bankers lobbying. Corporations such as Dow Chemical, DuPont, Kodak, Englehard, Tiffany and others have board interlocks over the years with the megabanks. Legislative subversion against Constitutional rights in silver has gone on for generations. The Commercial & Financial Chronicle, June 27, 1946, page 3482, had New York Congressman Emanuel Celler, complained about so-called "wild West" tactics on the part of the Silver Senators because they sought a 19.39 cent increase in the Federal price ceiling on payments per ounce for domestically mined silver! Celler puked out the following toxic blather---

"THE HOUSE IS WILD ABOUT THIS OUTRAGE, PARTICULARLY INIQUITOUS. MEN HAVE HOARDED SILVER. I HAVE HERE SOME OF THEIR NAMES TO GET A FREE RIDE AT PUBLIC EXPENSE."

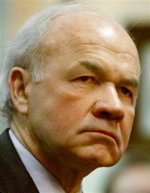

Celler (below) called the issuance of silver certificates "sheer inflation" and preferred currency redeemable in gold (only by foreigners) or not convertible at all! His definition of inflation was akin to a fireman calling rain "incendiary"---

Celler was a member of the New York County Lawyers Association and organized Brooklyn National Bank. He was counsel to Butchers Mutual Casualty Company; Brooklyn Retail Butchers Corporation; and Retail Butchers Holding Company---Who’s Who in America, 1941, page 543. I went all the way out to the ranch and brought Silver Sid back for this month (see below). His silver spurs spun as Sid made a particularly loud pop with his bullwhip while I told him the diseased details. As he put on his silver concho belt he remarked to me that considering how Celler treated silver miners, he wondered if any of that beef was rustled!

To the consternation of the bankers and silver users, the so-called "Silver Bloc" won its sought after increase of 19.39 cents per ounce, raising the price to the low 90 cent range until June 30, 1948. The fact is, as an accompanying article admitted, that 90 cent price was only in step with "the world wide increase in the price of silver bullion." The silver users wanted to get silver at below average world market rates! And do so at taxpayer expense and to the sheer privation of the mining community! There is no use in pointing out that the Silver Users Association didn’t exist until 1947! Before that they were known as the "Silver Users Emergency Committee." Eastern Senators "were opposed to any substantial price rise." Sixty-two years later---they still are! Josiah Bailey, North Carolina Democrat, who voted for monetary silver and some fairplay for miners---

American Metal Market Magazine, August 10, 1988, reported that Jeffrey Christian of CPM Group, an individual who I have no use for (because he’s sought-after as a lecturer at SUA sessions), stated in an address to the Silver Users Association---

"I realize silver users don’t like silver investors and would rather not have them around."

Yet in the Commercial & Financial Chronicle, November 16, 1961, page 2187 we read of a Treasury Department proceeding---

"At this hearing, the Silver Users Association stated its position as being in favor of a free market for silver."

How can a free market in silver be construed to intimate that the Silver Users Association has absolute and exclusive rights to hard silver that totally override, supercede, and cancel out the rights of everyone outside its circle? Hey---we have a 14th Amendment in this country that guarantees equal protection before the law for everyone. No self-serving elitist organization can arrogate to itself all property rights to silver and persuade the government to use duress to force divestiture of our chosen retirement accounts and children’s inheritances. That Amendment is a right enjoyed by every American citizen who has the means to acquire any silver and the insight to do so. As we all know the United States Mint has had a Silver Eagle program through which millions of investors and collectors---not "hoarders"---own some silver. Unlike Federal Ripoff Notes, this silver cannot ever go broke and the chances of its value rising are as probable as the law of gravity.

"In a free and open market unfettered by manipulation and control, the silver users have no fear of the price."---Commercial & Financial Chronicle, April 30, 1953, page 1873---Donald Ramsey, SUA spokesman

Over nine years later Ramsey, then the SUA’s legislative lobbyist, repeated this claim (Commercial & Financial Chronicle, August 30, 1962, p. 909)---

"In a free market at least we could see all the cards on the table. A free and open market would be far less subject to manipulation or control."

We have excessively superabundant reasons for concluding that the SUA’s notion of a free market in silver means that silver should be free of charge to them---or nearly so, in paying token prices for many years to access it. Gouged taxpayers have been grievously injured and our military personnel put in mortal danger because the Silver Users Association is largely responsible for the absolute depletion of the one-time national silver reserve this country previously had. Every veteran’s organization should be up in arms over this dishonorable misappropriation that places their sons in peril. Butler did a piece on this disgraceful swindle entitled Pearl Harbor 2001

Along these lines it is a slap in the face to everyone in the armed forces that the Silver Users Association routinely meets at the Army-Navy Club in Washington, District of Columbia. That being the case, military personnel---dressed as civilians--- should picket those meetings. As an extension of military personnel interest in silver as a security issue, all gun owners in America should own some precious metal because it takes more than lead to safeguard one’s Constitutional rights. Friends, kindly post links to this appeal on the appropriate message boards so that the Second Amendment folks may protect themselves to a more absolute extent.

Paul Miller, SUA official, while opposing the silver exchange traded fund before the SEC, trapped his organization by stating---

"The Silver Users Association supports the buying and selling of silver as an investment."

http://www.resourceinvestor.com/pebble.asp?relid=17121

OUR RESPONSE TO THE SUA

There is no need for confiscation or lawsuits. Just allow a free market in silver. That means a free market for everyone who has the means with which to acquire any silver. Let no one be coerced to sell who is not of a mood to sell. No punitive taxation on sales which discourages "dishoarding." No more use of the term "hoarders," as it directly suggests that there are no ownership rights to silver for any other than industrial users. Silver has been a store of value for thousands of years, tremendously overshadowing the time it’s been an industrial raw material. Having the right to a store of value for personal savings is as elemental a right as the right to clothing, shelter, and representation in government. A free market in silver means no windfall profits tax. A free market in silver means no temper tantrums and bleating as to how non-manufacturers are holding silver. Hey---those of us who have "substantial" silver may want to become sterling jewelry manufacturers until our inventory is depleted, at which time we will enter the marketplace and compete with you for silver. As silver fabricators we can mark it up like a "REAL" silver user! A free market in silver means a termination of the SUA’s "us four and no more" attitude.

A free market in silver means no Treasury confiscation of silver mining shares under any so called "national emergency" or under the International Emergency Economic Powers Act and no Federal seizure of mineral properties. A free market in silver means production by private enterprise, not government management. It is not the business of government to act as supplier of raw material to industrial users. The sole exception would be national stockpiles for emergency, of which we have none remaining, courtesy of the forces of greed. Let those who absconded with the silver replace it! In a free economy the open market is supposed to fulfill the role of supplier to industry and can do so admirably well if unhindered by Government tampering! A free market in silver means no Federal edict declaring it illegal for citizens to own silver; those who cause creation of black markets are abominable charlatans. A free market in silver means no government value added tax (VAT). A free market in silver means metal is encouraged to come to market by means of only one route---competitive prices. Distressed sales will always occur on the part of individuals with personal problems such as catastrophic medical expenses.

The Silver Users Association is composed of highly informed persons. They monitor what we in the silver community say. They posted excerpts of my December 2005 Silver Investor Essay of the Month, Nine Billion Ounces in their Washington Report in January 2006. Their February 2006 Washington Report cited Butler’s article, Hit With The Stupid Stick Again and so we conclude, this composition will be observed. You don’t like us, huh? We don’t like you either. You’re slithering miscreants! We haven’t enticed Federal officials like Homeland Security into meeting rooms with us trying to get what we want. The most any of us have done is to complain to our Congressmen and Senators. We will be doing far more of that as time marches forward. I have read accounts of Romans mining in Spain and you should have to work under such conditions.

Ed Steer of Gold Anti-Trust Action Committee recently asked the pointed question, Why is this organization allowed to exist?

The sole answer can only be that America is immersed in the biggest spiderweb of financial racketeering and government corruption since Mussolini’s Fascist Italy. We must have legislation forbidding members of organizations such as the Council On Foreign Relations and others of like purpose, from holding any type government office, including especially appointed positions, to include Ambassadorial posts. At

http://www.silverusersassociation.org/pubpol/index.shtml we find---

"Building relationships with key decision makers."

By what means are these relationships built? How is a member of Congress approached for their support? Does it entail something besides, "help us, because we have employees in your district?" But the Silver Users Association has exported many thousands of jobs offshore as I documented in "Silver Users Exporting Jobs." More and more, silver users notion of "American employees" appears to be executives and managers. The Associated Press, December 13, 2007 reported:

"Dow Chemical Company will sell a 50 percent interest in five of its global businesses to a Kuwaiti company for about $9.5 billion to form a new joint petrochemicals venture, the company said Thursday.

Dow said the transaction with Petrochemical Industries Co., a subsidiary of state-owned Kuwait Petroleum Corp., is subject to the completion of definitive agreements and regulatory approvals."

Gone are the glory days for silver users when they could get silver "loans" from the Treasury Department, such as the 19,780,000 ounces Dow Chemical got for 91 cents an ounce, as reported by Coronet Magazine, April 1955, page 108.

I submit that the reason for such a big move is that Dow Chemical made the determination it won’t be able to source sufficient silver it must have for its chemical catalyst requirements unless it can do so under a different "front" name and by going more international than it already was. They count on Kuwaitis to be able to source silver for their future needs. Large silver stocks probably exist in Kuwait as investment holdings. My view is that Dow doesn’t deserve one more gram. I could see Kuwaitis offering to trade India some oil for silver. But the deal won’t have to be processed through the COMEX. Dow knows that Indians would be friendlier to Kuwaitis than to Dow, because India cannot forget the Bhopal disaster, the worst industrial disaster in history, caused by SUA member Union Carbide that merged into Dow Chemical.

The financiers have long been involved with Middle Eastern states. Eugene Robert Black, Pilgrims Society member, chaired the World Bank from 1949-1962 and was "financial advisor to Sheikh of Kuwait" (Who’s Who, 1971, page 192.) Black’s father chaired the Federal Reserve System from May 1933 to August 1934. The younger Black was a director of Royal Dutch Petroleum; Chase Manhattan Bank; Equitable Life Assurance Society; American Express; Electric Bond & Share; Howmet Corporation; Cummins Engine; New York Times; ITT and the Atlantic Council, a British front organization in the District of Columbia and chaired the anti-monetary silver Brookings Institution, 1962-1968---

DISMAL FATE OF CORRUPT MEN

I had a silver exec tell me several years ago that an acquaintance of his from Texas persuaded him to buy some Enron stock. He bought at $20, and bailed out at $4. His identity can’t be pried out of me with a crowbar. Of course, Enron went broke and cost some 20,000 employees their livelihood and life’s savings; and cheated California electricity consumers and ruined boatloads of investors. It turned out that top execs of Enron sold out at $80 and the shares were massively shorted. Since Enron went bankrupt, the shorts had no obligation to return any shares! The top exec was the infamous Kenneth Lay, a Bush supporter---who was also on the roster of Rocky’s Trilateral Commission which fact the media carefully avoided mention of---

Lay was convicted on six counts of fraud and conspiracy. However, he died allegedly of a heart attack near Aspen, Colorado on July 5, 2006. Otherwise he was on his way to a Federal penitentiary. In the early 1970’s guess what---Lay worked as a Federal energy regulator! That’s about what we think of Federal regulators (they cannot be trusted, because the record of regulatory agencies including the FDA, SEC and CFTC is that they were created to shield corruption and retard competition!) Another such example is that of Bernard Ebbers, the disgraced former chief of WorldCom, which also went bust in an $11 billion accounting fraud scandal. Some 830,000 investors were harmed by this swindle. Ebbers, seen below in an ebullient moment preceding his downfall, was sentenced to a 25 year prison term---

So I say, it is very possible that some personalities involved in the silver price suppression scheme described by Butler will suffer such a downfall. While Butler hasn’t been able to make a dent at the CFTC or the NYMEX, the problem for them is that he has established an unassailable public record. This is a problem for those folks that can’t be made to go away! It reminds me of how Stephen Seagal as Jack Taggart in "Fire Down Below" (1997) told the big shot that when he hit prison, there would be a special relationship for him there---

LET THE RED LIGHTS FLASH

In October 2005 Jason Hommel stated in Silver Users Fear Silver Shortage--

"Conclusion? If there really remains less than 150 million ounces of silver in above ground refined form, then there is about half of an ounce of silver per person in the U.S., which means that if you have a single ounce of silver, the SUA might say that you have "more than your fair share."

What is the fair share of silver for the SUA? Just everything of course. Of the 1,264,526,113 Washington quarters minted at Philadelphia and Denver combined during 1964, if 90% of these have been melted, which I think probable, that leaves 126,452,611 of the 1964 quarters. That adds up to 31,613 bags. Since 64’s are so prevalent in typical bags of 4,000 quarters, it might not be too far off base to figure that the 64’s represent as much as half the silver quarters still in existence. We cannot speculate just on original mintage figures, because the farther back we go, the more the coins vanish by attrition; so that would yield 63,226 bags. If the melting and other attrition figure is 95%, that’s only 31,613 bags of quarters. From 1960 inclusive through 1963, only 46.64% as many quarters were minted as the 1964 issue. Considering that at least 5% and maybe 10% of these coins are heavily worn, the supply of lightly worn coins shrinks to a still smaller pool.

Considering how many investors will want silver once the price can’t be controlled any longer, these bags---and dimes, and more so, halves---could end up leading the physical market. They could also lead the share market since shares can be authorized and issued to infinity. Keep in mind that the shares aren’t silver or gold, but one step removed; they’re a claim on resources. The Silver Users Association would appreciate getting these silver coins, and they almost certainly would---if they were in possession of the Treasury Department, where special interests prevail, and regular citizens are stepped on. The silver users have left us all floundering in their wake as long as we’ve been in silver. That’s because they’re intensely organized and lobby like crazy. We must be equally organized and present a united front to counter their intrigues. The shortage will thump them.

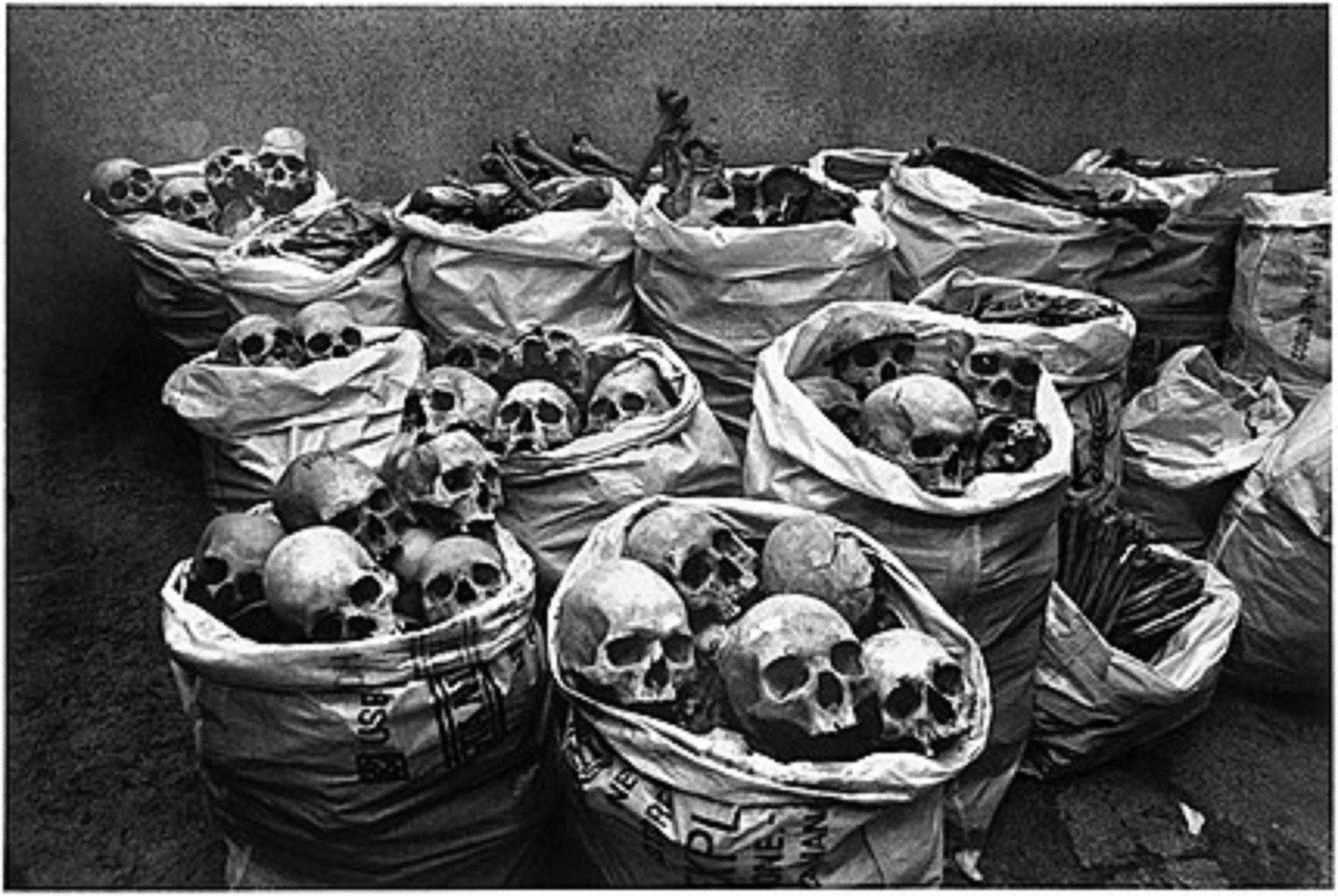

We silver investors and gold investors are resolute that if any attempt is made to trample on our ownership rights, we will strike back by filing a class action lawsuit against the Silver Users Association. Many attorneys are metals owners. The SUA took part in causing the supply void; we cannot be made to answer for their deeds. We will spread the message of what has happened all across cyberspace and it will not matter that news broadcasts and editors are devilish censors. We will organize permanent consumer boycotts of every current and past member of the SUA. There isn’t any SUA company whose offerings are so unique that companies outside their circle cannot supply equivalents to the public. No one of Indian descent in this country who feels any sympathy for his or her homeland should be doing any business of any kind with any SUA company. The reason? The Bhopal poison gas disaster of December 1984, caused by Union Carbide, then an SUA member, since merged into Dow Chemical. Deadly methyl isocyanate fumes are the most dramatic damage ever inflicted by any Silver Users Association company (skulls of autopsied victims whose brains were studied for effect of the fumes and how elegant does Tiffany’s think this image is)---

Let’s not forget about water pollution caused by silver users. According to http://www.waterkeeper.org/mainarticledetails.aspx?articleid=177---

"Dow Chemical and subsidiaries discharge a whopping 97 different toxins to 16 different U.S. water bodies, including a total of 606 pounds of the incredibly dangerous, dioxin. There is no known safe exposure limit to dioxin and it bioaccumulates—working its way up the food chain and passing from mother to child in the womb and through breast milk. So much for "Improved Living daily."

"DuPont continues to discharge PCBs to the Delaware River, even though this highly toxic substance is banned. In addition, Du Pont, in conjunction with the U.S. Army, is planning to discharge VXH, a form of caustic nerve gas, into the Delaware River. It will take one of Du Pont's "miracles of science" to undo the damage that it has done to American waterways."

Wow---talk about exceptional reasons to boycott these chemical giants. Since the other silver users consort with them in silver, boycott all of them! Tiffany piously bitched about a small silver mine in Montana but has no scruples as to associating with truly huge environmental offenders. See, being a silver user makes all of it OK. They have a "nonprofit" association with Federal officials tiptoeing around for them looking for ways to help them. Membership in the SUA makes everything sacrosanct!

Consider how many Mexican folks we have in the United States! I believe they would take an interest in knowing how the silver suppression has cheated their homeland out of fabulous wealth. I believe Mexicans could be tempted to boycott every SUA listed company. For the benefit of any Mexican folks reading this, consider these brief excerpts from the New York Times in June 1971---

"Six Silver Nations To Meet In Mexico On Sagging Prices---Mexico City---Mexico has called a meeting of the world’s principal silver producers to consider joint action to increase and stabilize sagging silver prices. Mexico’s Under Secretary for Nonrenewable Resources, Luis de la Pena Porth, who proposed the talks in March, PUTS THE BLAME ON SPECULATORS ON THE NEW YORK COMMODITY EXCHANGE FOR THE UNEXPECTED DROP IN SILVER PRICES SINCE THE UNITED STATES TREASURY STOPPED SELLING SILVER LAST NOVEMBER."

This was June 10, 1971, page 67. In defiance of economic law, the silver price slumped after the Treasury’s silver giveaways to the Silver Users Association ended as of November 11, 1970! From 1967 through 1970 inclusive, the Treasury gifted out 190,435,217 silver ounces to silver users. That’s an average of 47,608,804.25 ounces per annum. So, when that formidable supply stopped, naturally, everyone figured silver prices would start rising in response to supply/demand dynamics. NO---NOT ON THE COMEX!

"Mexico has complained that its mines have suffered severely from the falling price of silver, which has gone from a high of $2.48 an ounce in June 1968, to below $1.60 this June. The Mexican Under Secretary pointed out that at present, there was no relationship between trade in silver and actual silver supplies, SO THAT THE PRICE WAS FIXED BY THE SPECULATIVE FUTURES MARKET RATHER THAN BY CONSUMERS AND PRODUCERS."

Actually the Mexican official should have phrased his complaint, "rather than by demand and supply."

The other story, dated June 21, 1971, page 42, remarked, in regard to action to combat sagging silver prices---

"Diplomatic sources said the question was not discussed seriously. The sources explained that, while Mexico originally called the meeting with Peru’s backing in order to study ways of curbing speculation in silver, the delegations from the United States, Canada, and Australia had STRICT INSTRUCTIONS NOT TO DISCUSS ALTERNATIVE PRICING MECHANISMS nor ways of influencing demand or supply. During the three days of discussions, Mexico and Peru, which have been worst hit by the fall in silver prices, took the strongest position against speculators on the New York Commodity Exchange whom they blame for the bear market."

Fernandez Maldonado, Peruvian Mining Minister, went home disappointed because the United States and British Commonwealth nations Canada and Australia stonewalled the conference. Mexico and Peru should have retaliated by embargo on the export of silver for ten years. But they could not work such destitution on their miners. The story also said---

"The head of the United States delegation, C.D. Taylor from the economic office of the State Department, explained his Government’s position at the opening session."

Clearly the position of the United States Government was opposition to rising silver prices. That opposition remains in effect to this very moment. That’s why the Commodity Futures Trading Commission happily tolerates super concentrated short interest. Secretary of State William P. Rogers, Pilgrims Society member, was C.D. Taylor’s boss, and was a director of the Washington Post and 20th Century Fox Film Corporation, probably a silver user. Rogers came from a law firm that represented the filmmaker. Conflict of interest? Why should that trouble any silver users conscience? --

In March 2004 I presented Silver Users And Opium and took a swipe at the taboo organization---

The Silver Users Association---a gargantuan colostomy bag!

They need a horned devil symbol to use as a flag!

Let it read "Opium" and "Poison Gas" on their name tag!

Let all their scandals be broadcast, tongues will wag!

Pressure for use of silver and gold as monetary mediums will become so terrific that it will become a Herculean groundswell sweeping aside all opposing influence. We will not permit America to become Joe Stalin’s Soviet Russia where private property rights are obliterated. Collectively we silver and gold investors will assume the stature of the most result getting American who ever lived---a gold and silver President who loathed ephemeral paper money---Andrew Jackson, of whom it was said---

"HE IS NOT A MAN YOU CAN FIGHT AGAINST!"

"The Battle Of New Orleans" #1 hit of 1959---

http://www.tropicalglen.com/YR-1959.html